When elephants fight, it is the grass that suffers.

— Kenyan Proverb

Remember when PITAPOLICY reviewed oil data with Monotrome Consulting because oil prices fell into the red in April? Note: the price stood at a historic, record low of -40 dollars during a pandemic lockdown. Since then, Brent crude futures skyrocketed more than 80% in the second quarter. As the COVID-19 panic continues, conditions for an oil price war re-emerge… and our assessment still stands–two months after the protests in Lebanon and economic concerns in Iraq.

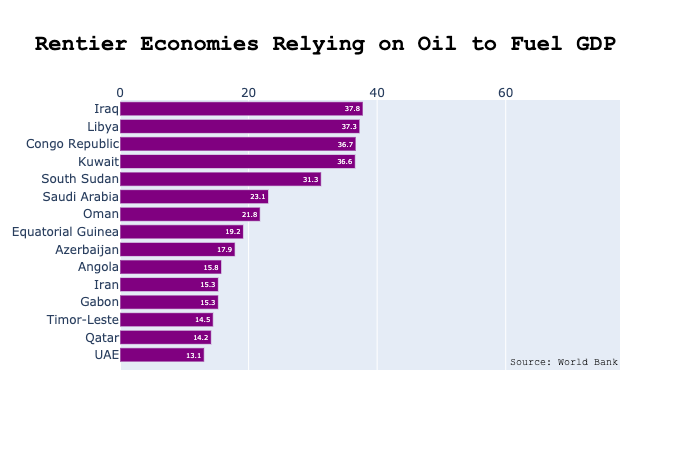

The conflict is not without risks to the belligerents. Saudi Arabia needs a crude oil price of $82/barrel in order to balance its books; any lower and the Kingdom will need to borrow money or draw down reserves to cover oil sales that are, effectively, at a loss. Russia may be better prepared to withstand oil shocks than Saudi Arabia, as the IMF believes that Moscow breaks even at $42/barrel. The current price, however, still results in a massive loss in revenue for Russia, and both countries will be cutting their noses off to spite their faces if the price war continues for long.

Again, the oil price war looms to the detriment of countries stuck in the middle.

Saudi Arabia has threatened to ignite an oil-price war unless fellow OPEC members make up for their failure to abide by the cartel’s recent production cuts, delegates said.

Wall Street Journal

In June, former OPEC member, Qatar, offered strong rebuke of the OPEC leader, Saudi Arabia:

It was sort of a double-whammy where the market got hit in a very big way…

Qatar’s Minister of State for Energy Affairs, Saad al-Kaabi, who is also CEO of Qatar Petroleum

Middle-Income Countries Stuck in the Middle

Meanwhile, energy demands fall back as middle-income countries, like Lebanon, are stuck in the middle: Protests broke out over its currency crisis, high food prices, and general displeasure with crony capitalism. Adding insult to injury, Lebanon’s attempt to capitalize on off-shore hydrocarbon efforts failed in late April. Moreover, the horrendous health effects of COVID-19 are accompanied by a global drop in demand for oil as factories across the world stay shuttered, and this has exacerbated the fall in oil prices.

Lebanon may serve as a microcosm of what may come if the U.S. prioritizes energy security over food and jobs security. Before oil prices started to drastically fall, the World Bank already forecasted that the 30 percent living under Lebanon’s poverty line could spiral up to 50 percent. Higher-income countries are not immune: by April, 26 million Americans had filed jobless crimes since COVID-19 forced massive furloughs and layoffs.

The International Energy Association issued a report finding that all energy sources dropped in response to COVID-19, with the exception of renewables, which “posted a growth in demand, driven by larger installed capacity and priority dispatch.”

…the IEA expects the fall in oil demand this year to be the largest in history. More recently, energy giants BP and Shell announced they have both lowered their respective long-term oil price expectations through to 2050.

CNBC

Perhaps the best strategic option is to let Saudi Arabia and Russia bash each other for a bit as advanced and developing economies deal with the socio-economic challenges posed by the pandemic, such as food security. The lesson learned from the EU-Russia oil price conflict of 2009 is telling: the US should let the belligerents joust each other rather than intervene. The American economy will be better served in the long term by reducing American dependence on foreign energy sources and the unpredictability of the international oil barrel prices.